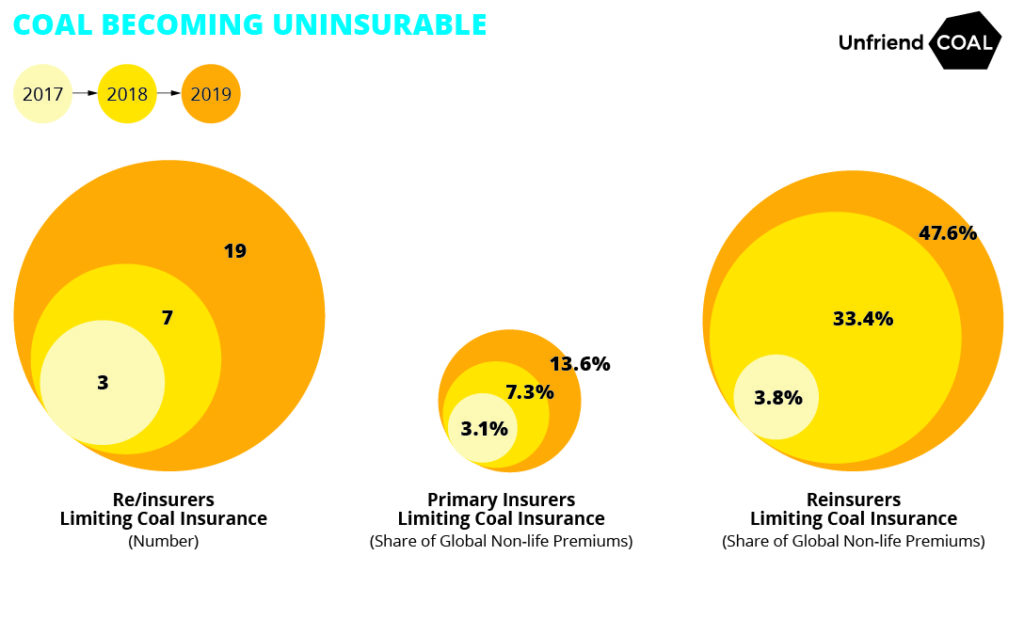

The insurance industry’s shift away from coal, the biggest source of CO2 emissions, is accelerating. When we launched our 2019 coal insurance scorecard in early December, we were excited to see that since April 2017, 17 insurers had withdrawn from the coal sector. What used to be a European phenomenon had also ignited action among Australian and US carriers.

Little did we suspect that before the year was out two more insurers would join the trend in the form of Liberty Mutual, the global specialty insurer and The Hartford, a large P&C insurer in the United States. With these additions insurance companies withdrawing from coal now account for 13.6% of the global insurance and 47.6% of the reinsurance market (measured by non-life premium income).

Many insurers which have not adopted coal exit policies will not provide cover in theenergy and power sectors anyway, and so the full impact of the shift away from coalgoes well beyond the market share of action takers. According to Willis Towers Watson it is becoming more difficult and expensive for coal companies to access insurance, putting them at a disadvantage with renewable energy providers.

What comes next for coal insurers? Who will claim the 20th spot in the roll call of the Unfriend Coal campaign? Four observations at the start of the new year:

First, with Chubb, AXIS Capital, Liberty Mutual and The Hartford taking action, the shift away from coal has firmly established itself in the US insurance industry. The position of AIG, which according to Finaccord ranks among the three biggest coal insurers worldwide, has become indefensible. Even national carriers such as Travelers and Nationwide will be at pains to justify their lack of a coal exit policy now that The Hartford has moved.

Meanwhile the Lloyd’s market remains the only major European provider of coal insurance. AXIS Capital was the first specialized Lloyd’s carrier to take action on coal, while other specialty insurers are opportunistically exploiting the market’s hands-off approach. More Lloyd’s insurers which have shown concern for climate risks such as Beazley, Hiscox and the Markel Corporation need to follow AXIS Capital’s lead and increase the pressure on the laggards at Lloyd’s. At the same time the Corporation’s management, as the keeper of the Lloyd’s brand, must makeit clear that insuring coal is no longer compatible with the reputation of a responsible insurance provider.

Now that most global players have left the market for new coal, insurers in Asia, where 80% of the coal power plants under construction or in the pipeline are located, need to realize that covering new coal projects is incompatible with the commitments of their governments to the Paris Agreement. As a gold sponsor of theTokyo Olympics and a member of the Japan Climate Leaders Partnership, Tokio Marine – a global top-10 coal insurer – is well placed to be the first Asian insurer to move out of coal. Samsung Fire & Marine Insurance is vulnerable to similar public pressure through its association with a global brand marketing consumer goods to a young generation.

While the combined coal exit policies of the insurance industry are taking a toll on the coal sector some policies amount to little more than window dressing. Liberty Mutual states that it will no longer insure new clients from the coal industry but apparently continues covering new coal projects. Spain’s Mapfre issued a broad public statement on coal but has not published a detailed policy. China’s Ping An adopted criteria on coal projects which allow two thirds of the power plants currently under construction or in the pipeline to slip through the net. Many other carriers have stopped insuring new coal projects but are not prepared to phase out support for ongoing coal operations in line with the findings of the IPCC. Campaign groups will continue to pressure these insurers to adopt policies which match international best practice.

Momentum feeds on momentum, and I am confident that the insurance industry’s shift away from coal will continue to accelerate. As I write this deadly bushfires have marooned thousands of people on beaches in Australia, where the Sunrise Project is headquartered. Insurers which still hesitate to do the right thing should be aware that their social license to operate may vanish suddenly as the risks of an unmanageable climate breakdown start to sink in around the world.

Peter Bosshard directs the Finance Program of the Sunrise Project and coordinates the Unfriend Coal campaign.